FUNDING

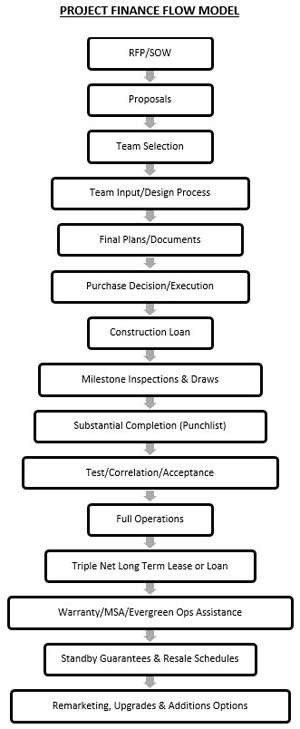

A tec, Inc. can often help with a financing approach that preserves important capital. The financed principal balance at a ten year horizon is typically reduced nearly 40% through the use of our contracting and funding techniques. Atec’s Equipment Maximization approach provides additional risk reduction and financial advantage through asset re-classification, relocation, and resale alternatives.

To obtain the lowest possible interest rates for long term financing/leasing, considerations beyond credit history include:

- Interim loans for manufacturing, installation and construction

- Draw inspections

- Triple net borrower accords

- Appraisal reconciliations

- Secondary guarantees

- Equipment resale schedules

- Maintenance service agreements

- Collateral purchase & marketing options

Financing Options usually require an executed MSA between Atec and Client, as an asset protection for the lender. In recognition of a provided Financing Package, Atec gains a first look at future Client test cell builds and upgrade projects during the Financing period.

Construction, Architectural, and Utilities work, Appraisals, Legal Fees, Permits, etc., can often be bundled within the Project Finance arranged by Atec. For all projects—large and small—Atec is adept at handling wire transfers, milestone certifications, letters of credit, and export documentation, as well as multiple billing methods and funding sources.

Atec can work with our clients in coordinating transaction layers to maximize the benefits and meet the concerns of all parties. We can facilitate the needed discussions to move forward with such a financing program upon selection and bring all participants into an integrated team for the project.